This is the second in a series of letters providing guidance on balance sheet risk management, following letter 99-CU-12 which addressed real estate lending.

Credit unions have been highly successful in accomplishing their mission of providing service to their members. Increased loan volumes have occurred in the context of steady earnings and improved capital positions. The purpose of this letter is to assist credit unions in sustaining past levels of success by ensuring that the means to providing member service are in place and well managed.

Liquidity risk is a widely acknowledged current issue worthy of scrutiny. This letter emphasizes the importance of liquidity risk management and offers guidance on forecasting liquidity needs.

Liquidity risk is the funding risk that, due to a lack of sufficient stable sources of funds, a credit union will be unable to continue meeting member demands for share withdrawals and/or new loans.

Sources of liquidity are found primarily in core deposits and, secondarily, in investments that can be readily sold without significant delay or market loss. Alternative sources of liquidity are found in borrowing arrangements, such as repurchase agreements and committed lines of credit. The alternative sources of funds are less permanent in nature, and so do not provide a continuous basis for funding loan demand or share withdrawals.

Credit union liquidity is decreasing and has been reduced to the lowest level in over a decade. This situation may persist for some time. When there is an adequate surplus of funds available, the risk of illiquidity is of little concern. However, when liquid funds are depleted, the risk of illiquidity moves to the forefront of concern. Inadequate liquidity can cause potential disruptions in service to a credit union’s members and thereby diminish public confidence. It can also increase an institution’s vulnerability to other market and operational risks.

Liquidity problems or special needs often emerge as a symptom of other problems. For example, the good economic conditions that currently benefit credit unions and their members may change. Members could become financially overextended resulting in higher delinquency, reduced principal repayments, and increased share withdrawals thus reducing sources of funds that the credit union may have relied upon to ensure “business as usual” stability.

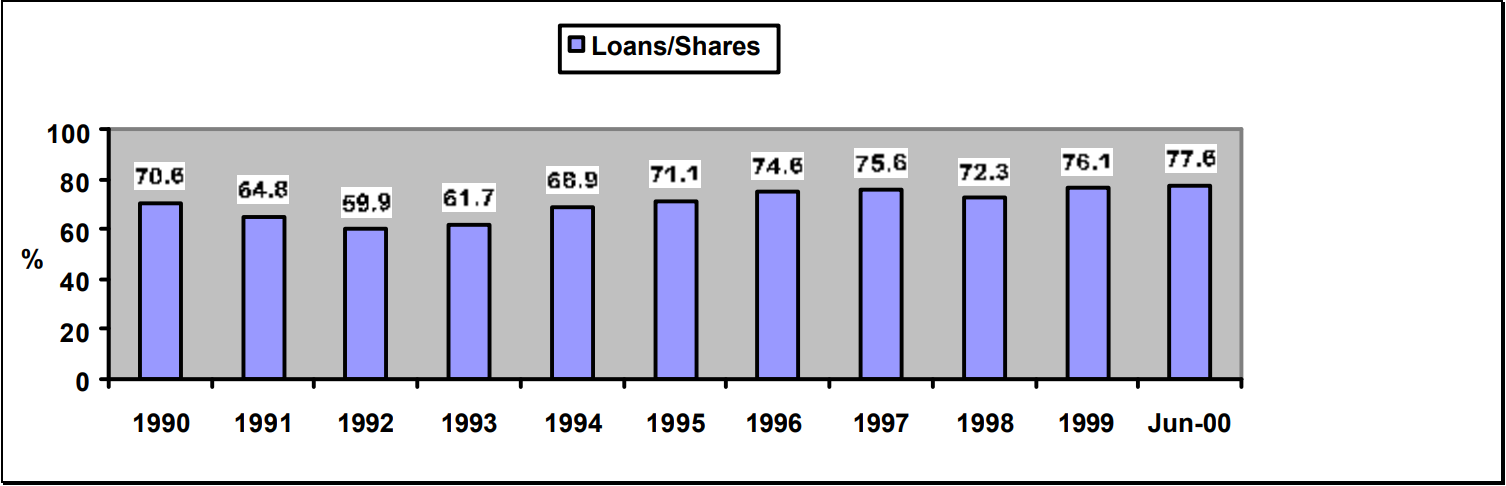

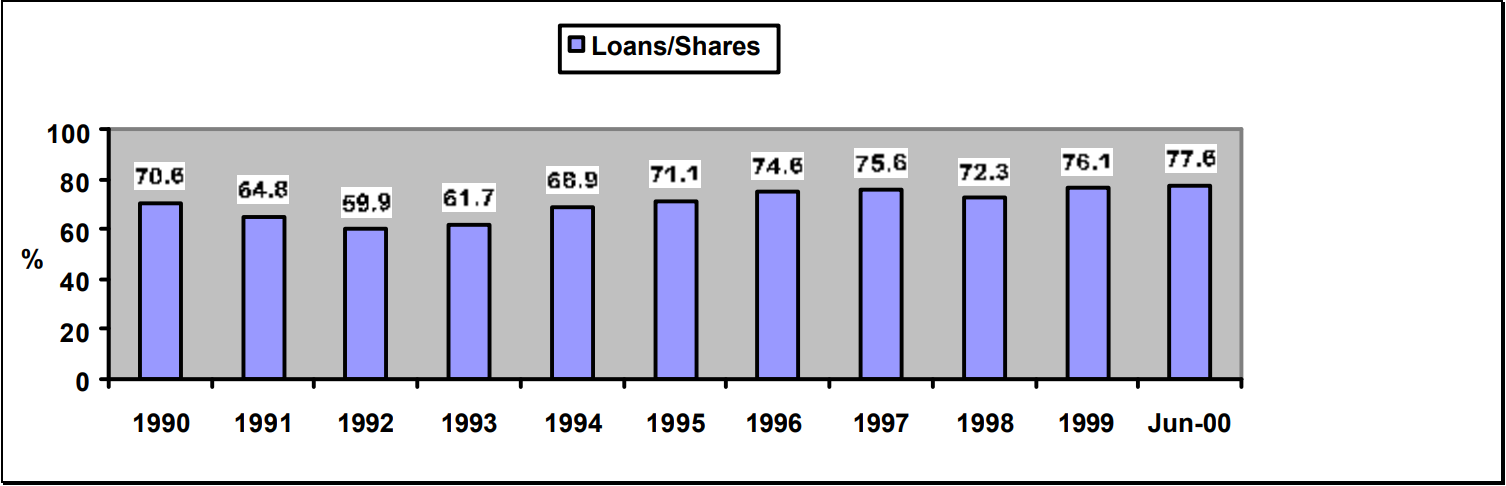

Credit unions have successfully managed high loan-to-share ratios in the past. After many years of excess or adequate liquidity levels, credit unions are once again faced with the challenge of managing in a tighter liquidity situation, while continuing to meet members’ needs. Credit unions should take care now to address the potential liquidity demands that have resulted from the robust demand for credit.

Presently, a number of key indicators exist that warrant immediate attention to liquidity risk management. Loan growth has caused a notable decline in liquid assets. For the period of June 30, 1999 to June 30, 2000, the 12.7 percent increase in loans has been funded by a decline in investments and increases in rate-sensitive money market shares and share certificates (see Chart 1 – Call Report Data). Loans are less liquid than investments since they are less marketable. Share drafts are easily withdrawn, and could produce further pressures on liquidity if this occurs. Rate sensitive shares (money markets and certificates) put pressure on profitability by increasing the cost of funds in rising rate environments. All of these factors pose risks to the credit union’s profitability and capital.

Natural Person Credit Union Call Report (5300) Data (in $ Millions)

| Loans and Shares | 6/30/99 | 12/31/99 | 6/30/00 | Change +(-) 6/99 to 6/00 |

|---|---|---|---|---|

| Total Loans | $254,993 | $271,547 | $287,447 | 12.7% |

| New Auto | 48,673 | 52,454 | 56,568 | 16.2% |

| Used Auto | 51,698 | 54,536 | 58,404 | 13.0% |

| 1st Mortgage RE | 67,061 | 70,906 | 74,622 | 11.3% |

| Other RE | 30,167 | 33,084 | 36,841 | 22.1% |

| Credit Cards | 18,471 | 20,120 | 19,648 | 6.4% |

| Unsecured Loans | 21,848 | 22,308 | 21,995 | 0.7% |

| All Other Loans | 17,075 | 18,139 | 19,369 | 13.4% |

| Total Investments + Cash | $138,695 | $126,518 | $127,559 | (8.0%) |

| Total Shares | $356,633 | $356,921 | $370,599 | 3.9% |

| Share Drafts | 42,562 | 44,824 | 49,850 | 17.1% |

| Regular Shares | 139,015 | 134,032 | 137,685 | (1.0%) |

| Money Market Shares | 45,782 | 47,379 | 48,771 | 6.5% |

| Share Certificates | 87,611 | 89,665 | 92,668 | 5.8% |

| IRA/KEOGH & Other | 41,663 | 41,021 | 41,625 | (0.1%) |

| Year | Loans / Shares (percent) |

|---|---|

| 1990 | 70.6 |

| 1991 | 64.8 |

| 1992 | 59.9 |

| 1993 | 61.7 |

| 1994 | 68.9 |

| 1995 | 71.1 |

| 1996 | 74.6 |

| 1997 | 75.6 |

| 1998 | 72.3 |

| 1999 | 76.1 |

| Jun-2000 | 77.6 |

These trends further emphasize the need to focus attention on liquidity risk management.

| Loans and Shares | June 1999 | December 1999 | June 2000 | Change +(-) 6/99 to 6/00 |

|---|---|---|---|---|

| Total Loans | $238,952 | $1,278,630 | $1,207,724 | 405.4% |

| Guaranteed Lines | 106 | 80,203 | 40,162 | 37,789% |

| Loans to Members | 211,786 | 1,170,644 | 1,083,276 | 411.5% |

| Other Loans | 27,060 | 27,783 | 84,286 | 211.5% |

| Total Investments & Cash & Bal. Due | $45,480,380 | $37,502,496 | $36,056,012 | (20.7%) |

| Total Shares | $39,624,265 | $32,768,407 | $32,505,803 | (18.0%) |

| Member Daily Shares | 22,773,337 | 17,503,054 | 16,104,314 | (29.3%) |

| Other Shares | 16,850,928 | 15,265,353 | 16,401,489 | (2.7%) |

Credit unions should periodically report, document, and analyze their liquidity positions as part of a sound funds management program. Proper forecasting and planning help anticipate needs before they arise and provide considerations for potential solutions. Good planning, monitoring, and controls are necessary to ensure that when liquidity pressures emerge or increase, appropriate actions can be taken to minimize the impact.

One example of a liquidity-forecasting tool is a projection of net sources and uses of funds, and the resulting forecasted level of cash and short-term investments (see Attachment). Such a tool could be used by a credit union to project liquidity needs over a 12-month horizon.

What are some possible solutions to liquidity pressures?

Credit union officials may wish to consider actions such as, but not limited to, the following:

To successfully sustain the growth in lending and service to members, credit union officials and senior management must consider how a liquidity problem would be resolved. Now is an excellent time to revisit or, if need be, develop liquidity risk management policies, procedures, and practices. Each credit union’s liquidity management process should be appropriate for the overall level of risk incurred considering asset size, capital adequacy, and products or services offered.

In order to establish a reasonable capacity to respond to liquidity needs, I encourage you, at a minimum, to take the following actions as part of your credit union’s liquidity management processes:

If you have any questions, please contact your examiner, NCUA regional office, or state supervisory authority, in the case of state chartered credit unions.

Norman E. D’Amours

Chairman National Credit Union Administration Board